If you want to predict incomes in premiums, losses in claims, detect early risks, and reduce the underwriting process, you need insurance agency software based on ML.

Specialized software is an integrated gear of insurance businesses. Every company in this field has these Insurance Management systems installed on their PCs, laptops, and mobiles. In this article, an AI solutions developer describes the basic components and the latest ML features of these systems.

In brief, software for insurance companies represents a combination of CRM and ERP systems. It serves to facilitate the work with customer management and resource planning in this business.

Companies that financially protect individuals and businesses in diverse situations operate enormous volumes of finance. In 2019, in the USA, this industry’s net premiums totaled $1.32 trillion. That is why it needs traditional automation combined with AI models to operate successfully.

There are two types of software for insurance agencies. The first type represents end-to-end systems. And the second type represents single solutions with one or more functions that address a certain business goal. Single solutions/ functions can vary. They can apply individually to the companies. Or they can be integrated securely into the end-to-end insurance software. The latter, with multiple integrations of single solutions, form insurance software ecosystems.

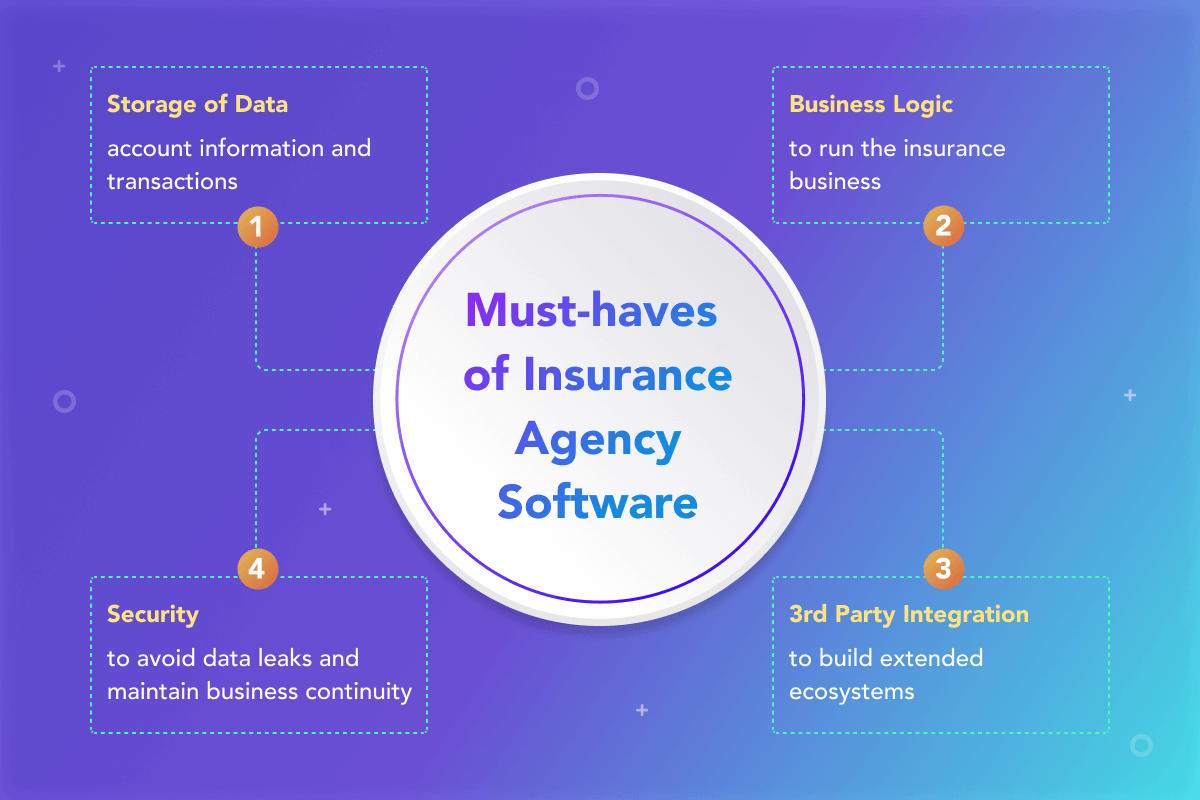

Must-Haves of Insurance Agency Software

ML Functions of Insurance Management Systems: Potential Fraud Detection

AI software in your company will do more precise fraud detection than traditional systems do and alarm suspicious claims in real time.

Companies need to be protected from false claims. Fraud detection systems that are based on rules approach only analyze structured data. The solutions based on ML dig not only structured data but also all relevant to the claim information and documentation. Further on, these systems predict and tag abnormal behavior, if any. They aim to get an “integrated view and better insights” to detect potential fraud, PwC specifies. In this way, the clerks and agents can be aware of hidden threats in claims and react accordingly.

As a bonus, the AI system also leverages its dynamic datasets in the back office. This enables it to learn from experience. This means that in case it detects similar behavior that was registered before as fraud, it will already know how to react to it.

Risk Management

Insurance management systems that are based on machine learning find and analyze all relevant and hidden information about the clients and alert high-risk clients to protect the company from losses.

Insurers endeavor to collect more finance in premiums than to pay out in claims. The difference between the two represents their profit and can count enormous sums. On the other hand, if the companies pay out irrelevant claims, the business will close. Companies must manage effectively at all stages and eliminate high risks. The sooner, the better.

The software with big data and data mining algorithms finds and analyzes all transaction patterns of the clients and also “watches” the client’s interactions, credit history, and income. To learn more about AI predictive analytics in FinTech, please click here.

Unlike traditional systems, smart risk management algorithms in insurance agencies dig all relevant information to assess early risks and protect the company from losses.

AI Assistants and Chatbots

Insurers refer to AI assistants or chatbots when their sales agents encounter difficulties. These can include new products for industries. In this case, agents call the sales Support center. At this stage, queues of queries can appear that often result in lost sales opportunities.

The company can solve this issue by applying chatbots or AI assistants. Digital twins can serve inquiries from sales agents and substitute support centers. For example, these solutions can guide sales agents through business protocols.

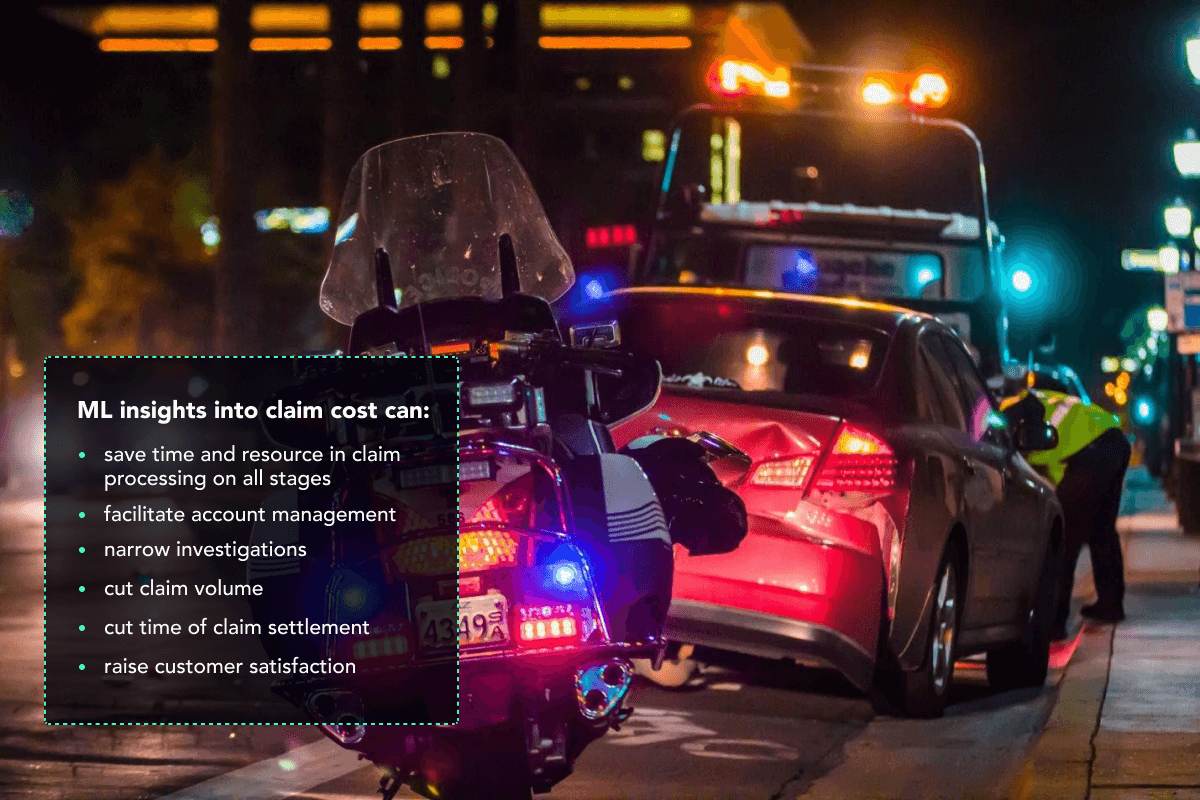

Claim Costs

ML algorithms can give insurers valuable insights into claim costs during claim processing.

Claim processing from registration to settlement has stable stages but encumbered workflow. ML insights into claim costs can facilitate this workflow.

As a bonus, having analyzed large volumes of the claim costs, predictive algorithms give the companies insights into the volume of prospective claim reserves.

Insurers process claims either with ML models or via traditional software.

- For example, when a company processes an automotive claim for repair, it needs to assess the case. The cases when the clients and the company agree on the costs can be automated with traditional software;

- On the other hand, if a client addresses the company with an uncertain case, the company needs to estimate whether or not to accept the claim. In these cases, insurers can apply AI models. For example, as suggested by Forbes, the company can guide a client through taking pictures of the possible damage via a mobile application. Then, computer vision in the insurance company will analyze the pictures. And further, the back office will process the results to decide whether to accept or decline the claim.

Next Distribution Model

Insurance Management Systems can generate personalized policies and offer them to clients.

Personalized insurance policies are not “sewed for the market,” and that is why they are likely to get customers’ attention. To create a personalized insurance policy, ML models run through a complex process.

They:

- Analyze customer’s profile;

- Predict insurance cases;

- Calculate and assess risks;

- While following the agency’s business logic.

Insurance companies can create a separate workflow for this process to save the time of skillful personnel. They can employ AI assistants or chatbots that will offer personalized policies to clients.

Investing in digital distribution will bring significant benefits to companies:

- Rise of the company’s resilience during a repeated pandemic “close-open” routine;

- Fast servicing of customers;

- Unloading of agents;

- Raisinagents’ effectiveness.

This solution is meant both for clients and agents. Clients are likely to learn personalized insurance policies from a smart assistant. And agents love digital tools that save them from routine work and are always ready to rig with the new apps.

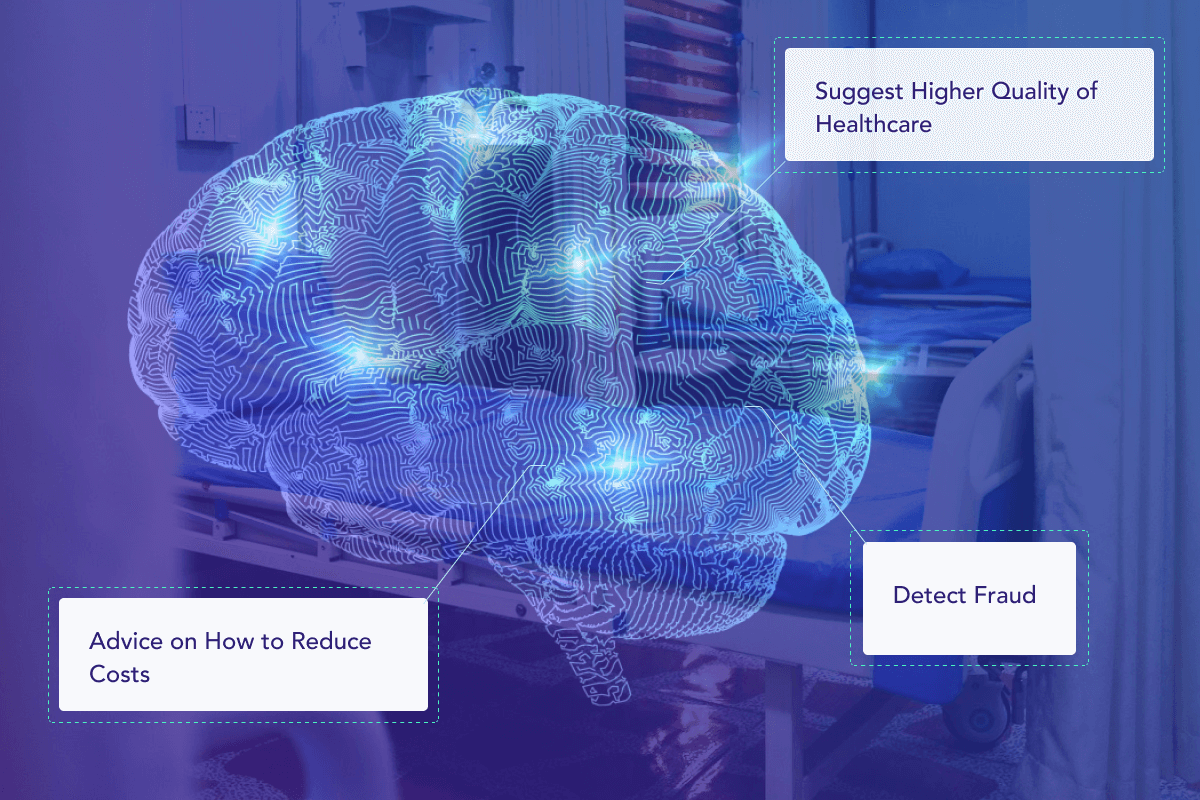

Improving Underwriting Process

Smart solutions analyze vast volumes of data in the claims to cut the underwriting process.

ML models contribute much to the process of underwriting. For example, healthcare insurance covers diseases, accidents, disabilities, and deaths. While processing these claims, ML solutions analyze huge masses of data such as insurance claims, providers, and medical records to cut the routine. Then, they apply it to the company’s business logic to form personalized coverage. This benefits the insurers, medical personnel, and the clients.

McKinsey reports ML solutions to bring in the healthcare insurance businesses multiple benefits (please see below on the image).

Connectivity with ML and IoT Devices of Clients

The connectivity of insurance agency software with the clients’ smart systems has a big impact on client-agency relations.

Certain clients can use such smart systems as smart houses and predictive maintenance of households. Commercial clients can use computer vision in fleet management, predictive maintenance of machinery in warehouses, and drones in agriculture. Connectivity with these devices allows for claims processing and settlement and raises customer loyalty.

Analysis of the Impact of Gross Technological Shift

AI solutions can analyze gross technological changes that will enter the industries and their impact on companies.

In the future, insurers will face a commercial scale of smart equipment in many industries, such as healthcare, automotive, and agriculture. AI models will guide carriers through new devices across industries, analyze the new risks and opportunities, and advise new insurance policies.

Softengi AI solutions developer designs and trains custom software on a cost-effective basis. It can include fraud prevention, risk management, AI chatbots for clients and agents, and computer vision for data interpretation.

Key Takeaway

This article gives coverage of the must-haves of software for insurance agencies and the latest AI functions. It describes fraud prevention, risk management, AI chatbots, personalized insurance policies, and claim processing. It also gives insights into the benefits of connectivity of this software with the client’s systems based on AI and IoT, for example, smart houses. And it touches upon the role of AI for insurance businesses in prospective technological shifts across industries.